#17: What is the meaning of Hawkish

13 stycznia, 2023 2:02 pm Leave your thoughtsContents:

U.S. interest rates are controlled by the nation’s central bank, the Federal Reserve. The bank has Congressionally mandated tasks to pursue a monetary policy that encourages employment, keeps prices relatively stable and moderates long-term interest rates. Keeping interest rates low is sometimes called a dovish policy; raising them is sometimes called a hawkish policy. When government monetary policy is driven by a hawkish view, policymakers are focused on keeping inflation in check. Besides doing this by raising interest rates, they also do this by reducing the money supply. The effects on investors and others can be sweeping, ranging from higher unemployment and less availability of credit to more stable and predictable prices.

It is important to note that these meetings play an important role in the economy and are widely anticipated by market watchers, traders, and consumers alike. It may sound a bit strange, but gold has ornithological preferences. Gold is a non-interest bearing asset, so higher interest rates make it less attractive compared to interest-bearing assets. Gold is also believed to be an inflation hedge, so hawkish monetary policy implemented to keep inflation in check reduces the need to use gold for that purpose. Let us consider that you wish to trade USD/EUR, which is currently trading at an exchange rate of 2.

What are hawks and doves in monetary policy?

While they make it less likely for people to borrow funds, they make it more likely that they will save money. This website contains certain forward-looking statements that are subject to various risks and uncertainties. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, or state other forward-looking information.

Plus500SG Pte Ltd holds a capital markets services license from the Monetary Authority of Singapore for dealing in capital markets products (License No. CMS100648). Increased savings as higher interest rates could make it more attractive to save money rather than spend or invest it. Higher exchange rates as a result of higher interest rates, making exports more expensive and imports cheaper. A Cryptocurrency CFD is a tradable contract between the Cryptocurrency trader and broker that allows the trader to open a Crypto position without actually owning it. The trader has to pay the difference between the Cryptocurrency’s price at the time of contract and its current price to speculate on the price movements. DisclaimerAll content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only.

The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

The main way what does hawkish mean policymakers work to accomplish this goal is by lowering interest rates. In finance, hawk and dove refer to two different approaches towards monetary policy. A hawkish approach is focused on controlling inflation, even if it means sacrificing economic growth. A dovish approach prioritises promoting economic growth, even if it means allowing inflation to rise. Lower inflation rates as tighter monetary policy reduces the money supply and the ability for consumers and businesses to spend.

What does it mean to be hawkish?

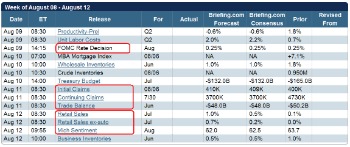

Accordingly, higher interest rates were seen in most countries around the world. But whether or not this hawkishness will stick out throughout the rest of 2023, is yet to be determined. In terms of segmentation, there are 12 Federal Reserve Banks in the US. Each bank is responsible for a specific geographical area and conducts monetary policy supervision, ensures financial stability, and provides banking services. Furthermore, each year, the Fed meetings eight times to decide on interest rates and monetary changes.

Economists Split on Whether Australia Will Pause Tightening – Yahoo Finance

Economists Split on Whether Australia Will Pause Tightening.

Posted: Mon, 03 Apr 2023 03:55:00 GMT [source]

The falling demand for the USD will further decrease its value in the market, leading you to place short or sell orders for the USD. The rising demand for the Dollar will further increase USD’s value in the market, leading you to place long or buy orders with respect to the USD. Lower interest rates tend to encourage investors to move their capital into higher-risk assets and discourage saving.

Definition of Hawkish monetary policy

These aren’t the only instances in economics in which animals are used as descriptors. Bulls and bears are also used—the former refers to a market affected by rising prices, while the latter is typically one where prices are falling. The opposite of a hawk is a dove, who prefers an interest rate policy that is more accommodative to stimulate spending in an economy.

The https://g-markets.net/ stance is typically used to reduce the risk of deflation. Investors prefer Hawkish policies because they reduce the risk of deflation. The Hawkish stance could be seen as a way to tamp down inflationary pressure before it gets out of hand – and has huge consequences for countries that have borrowed heavily. These policies are based on their outlook for the economy and what they believe will happen next. This was not the first disagreement between the ultra-hawkish Bolton and the occasionally more intervention-skeptic Trump.

This can have a positive effect on the stocks and indices within an economy, but a negative effect on its currency. This often comes at the expense of economic growth, as higher interest rates discourage borrowing and encourage saving. For the Fed, „dovish” means prioritizing the lowering of unemployment. It kept interest rates at near-zero levels to help reenergize the economy after more than 20 million people were unemployed. „While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses,” Powell said.

Since then, trillions of dollars have been erased from markets across the globe as equities and bonds were whipsawed by hawkish Fed policy, geopolitical chaos, Covid shutdowns and more. Waller, a member of the Fed’s board and its interest-rate setting committee, is considered hawkish, or more concerned about heading off inflation that spurring growth. An economic depression is a steep and sustained drop in economic activity featuring high unemployment and negative GDP growth.

The doves argue that inflation isnt bad and that it is bound to have few negative effects on the economy. They also believe that monetary policies that keep low-interest rates have a positive effect on the overall economy of a nation. A central bank’s monetary policy on interest rates is a key driver of the Forex market.

What Does Dovish Mean?

The long-term effects of dovish policies on economic stability can be uncertain. Therefore, policymakers must carefully balance the short-term benefits of promoting growth with the potential long-term risks of higher inflation and economic instability. A dovish approach prioritises promoting economic growth, often through measures such as lowering interest rates and increasing the money supply. A hawkish Fed will assume an aggressive stance that prioritizes keeping inflation low or getting it lower. Federal Reserve (or ‘Fed’) is hawkish or dovish, they’re referring to differing views on what monetary policy position the economy requires at that time. Higher interest rates make it more expensive for consumers and businesses to borrow money.

People are able to shop, build new houses, and manufacture more products. The whole process increases demand leading to the overall increase in the price of commodities and services. Also, when there is a high rate of employment, it means that many people are earning high wages. With this, people can afford services and products despite their high prices. When this happens, it creates a cycle of wage and price increase, leading to inflation. Dove refers to an economic policy adviser who advocates for monetary policies involving low-interest rates.

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

Financial services companies such as banks and brokerages also tend to have higher profits as rates go up, so these may represent bigger slices of investor portfolios during hawkish periods. For consumers, hawkish policy means fewer jobs as businesses restrain hiring. Loans for the purchase of cars and homes will carry higher interest rates.

As a group, government monetary policymakers tend to turn hawkish and dovish in response to economic cycles. If, on the other hand, the economy has been expanding for a while and inflation is starting to increase, a hawkish tendency is likely to become more noticeable. You are probably wondering why we write about birds on a website devoted toprecious metals and other investments. The reason is that “hawk” is a term used not only in ornithology, but also in monetary policy. It means a policymaker who is predominantly concerned about inflation. Hence, hawks generally favor higherinterest rates and tight monetary policy to deter inflationary pressures.

Inflation can occur when economic growth “overheats,” which higher interest rates are thought to moderate. Our materials may include historical appreciation percentages that are based on public auction sales and reflect historical price trends. Such information is not intended to be indicative of returns that would have been achieved on Masterworks shares during such periods. Fees, expenses and other factors will create significant differences between the performance of an investment in masterworks shares and historical artwork appreciation rates.

In fact, the United States people, as well as investors, prefer a Federal Reserve chairperson who is capable of managing the two positions. In other words, an individual who can switch between the two positions whenever the situation demands. Dovish is an expansionary monetary policy in which central banks decrease interest rates to increase the country’s money supply.

Categorised in: Forex Trading

This post was written by member666